Power your portfolio

with metals

Real Assets. Real Value. Diversify with Strategic Metals — fully insured, MiCA-compliant, and stored in EU duty-free vaults. Protect and Grow your Wealth in the Age of the Polycrisis

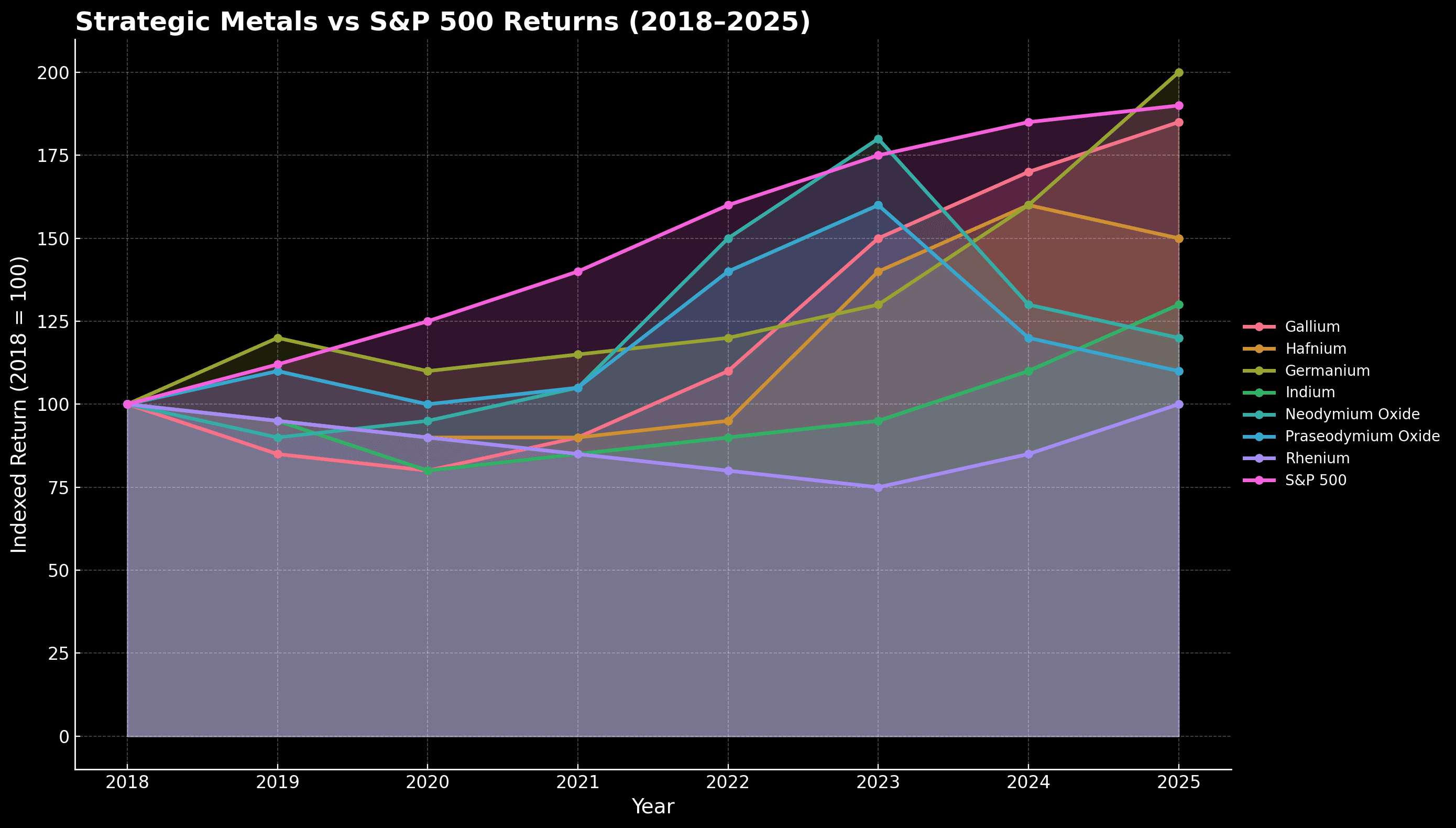

Strategic Metals vs S&P 500 Returns (2018-2025)

Strategic metals have consistently outperformed traditional indices during key industrial cycles. With rising demand in defense, renewables, and semiconductors, this asset class offers real-world utility and strong price fundamentals.

Past performance is not indicative of future results. Data shown in USD. Actual returns may vary due to market and currency fluctuations.

Energy transition demand

Critical to wind turbines, solar panels, EVs and data centers, strategic metals are the backbone of the energy and technology transition. As governments and industries decarbonize, demand is set to accelerate globally.

Inflation resilience

Unlike fiat currency, metals can't be printed. Their tangible, finite nature makes them a proven hedge against monetary debasement and long-term inflation — even when markets pull back.

Physical scarcity

Global reserves are limited. Supply chains are fragile. Strategic metals are sourced from geopolitically sensitive regions — but stored securely in bonded EU vaults, out of reach of systemic risk.

Strategic metals demand forecast to rise 30–50% by 2030

Used in defense, EVs, wind turbines, semiconductors, 5G infrastructure

Low correlation to equities, bonds, and crypto – true portfolio diversification

Reserve assets valued daily, audited semi-annually

Transparent, NAV-based pricing — always updated, always public

What You Own

Every token corresponds to a fixed, transparent allocation of seven metals selected for their critical industrial and technological value:

Hafnium

(Hf + Zr, min. 99.9%)

for nuclear rods, microchips, aerospace

Rhenium

(Re, min. 99.9%)

key to high-temperature turbines and catalysts

Gallium*

(Ga, 99.995%)

used in 5G, semiconductors, and LEDs

Indium

(In, 99.995%)

indispensable for touchscreens and ITO coatings

Neodymium Oxide

(Nd₂O₃, min. 99.5%)

magnetic backbone of EVs and wind turbines

Praseodymium Oxide

(Pr₆O₁₁, min. 99.0%)

used in alloys, magnets, and clean energy tech

The basket doesn't change. It's physically allocated, fixed-weight, and stored — not just referenced.

All metals are held in a dedicated custody account, managed by a CySEC-regulated investment firm and stored at Metlock GmbH in Frankfurt — VAT-free, fully insured, bankruptcy-remote.

Each token represents direct ownership of a fixed basket of 8 strategic metals — including hafnium, rhenium, gallium*, germanium, indium, neodymium oxide, praseodymium oxide, and germanium — in predefined quantities. No derivatives. No rebalancing. Just real, insured assets.

Commodities News

Joint investments, knowledge sharing, and the coordination of strategic reserves are aimed at strengthening supply chains.

Source: | Published on: 5 March 2026EU: Industrial Accelerator Act to Boost Competitiveness

Source: | Published on: 4 March 2026With Pentagon support, the aim is to reduce dependence on Chinese imports.

Source: | Published on: 3 March 2026The DFC will support the recovery of critical raw materials from mine tailings with up to five million U.S. dollars.

Source: | Published on: 3 March 2026Investments are flowing into mining and research projects with twelve international partners, including strategic collaborations for lithium, synthetic graphite, and rare earth elements.

Source: | Published on: 3 March 2026Neo Performance and Cyclic Materials: Non-binding Memorandum of Understanding for Recycling Rare Earth Magnet Materials

Source: | Published on: 2 March 2026With the help of the precious metal ruthenium, rubber gloves are being given a new purpose in the fight against greenhouse gases.

Source: | Published on: 2 March 2026Lynas will be allowed to operate its refinery in Malaysia for another ten years. However, the decision comes with a significant twist: by 2031, no radioactive residues may be generated in the element separation processes.

Source: | Published on: 2 March 2026From Brasília to Seoul, countries are ramping up efforts to challenge China’s dominance in rare earths.

Source: | Published on: 27 February 2026Europe’s raw material supply could also benefit from the free trade agreement in the long term.

Source: | Published on: 27 February 2026

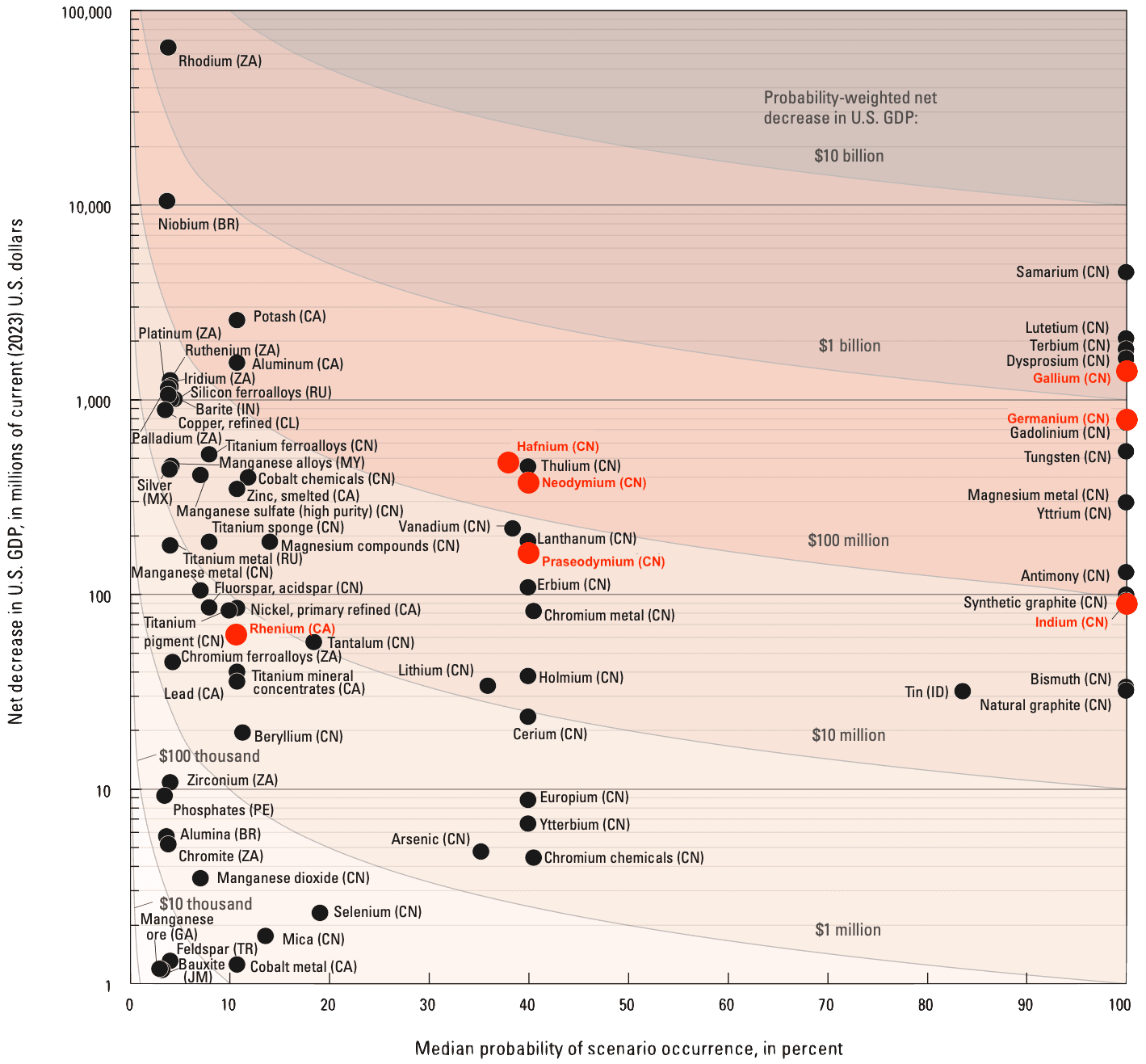

The 2025 USGS report presents a comprehensive risk assessment for 84 mineral commodities to determine their inclusion on the U.S. List of Critical Minerals (LCM). The updated methodology evaluates supply risks based on two main criteria: (1) the potential economic impact of trade disruptions using advanced modeling of GDP effects, and (2) domestic supply-chain vulnerabilities, especially when a mineral relies on a single U.S. producer (SPOF). The economic model quantifies the probability-weighted net decrease in U.S. GDP for over 1,200 trade disruption scenarios, reflecting the country's reliance on imports and concentrated global production. Commodities exceeding a threshold of $2 million annualized GDP risk, or affected by a domestic SPOF, are recommended for inclusion. For 2025, six minerals—potash, silicon, copper, silver, rhenium, and lead—are newly recommended for addition, while arsenic and tellurium are suggested for removal. The final list categorizes minerals by risk (high, elevated, moderate, limited, negligible), supporting strategic policy decisions on mineral security and prioritization of risk mitigation strategies.

China has cracked down on foreign companies stockpiling rare earths, a move that could impact global supply chains. The move is seen as a way to control the rare earths market and prevent foreign companies from stockpiling rare earths. The move is seen as a way to control the rare earths market and prevent foreign companies from stockpiling rare earths.

The Global Critical Minerals Outlook 2024 provides a comprehensive analysis of the global critical minerals market, including supply, demand, and trade patterns. The report highlights the importance of critical minerals for the global economy and the need for sustainable and responsible mining practices. The report also provides a detailed analysis of the global critical minerals market, including supply, demand, and trade patterns.

The IEA_GCMO2024_Final_webinar provides a comprehensive analysis of the global critical minerals market, including supply, demand, and trade patterns. The report highlights the importance of critical minerals for the global economy and the need for sustainable and responsible mining practices. The report also provides a detailed analysis of the global critical minerals market, including supply, demand, and trade patterns.

The US rare-earth neodymium magnets, China, and geopolitics provides a comprehensive analysis of the global critical minerals market, including supply, demand, and trade patterns. The report highlights the importance of critical minerals for the global economy and the need for sustainable and responsible mining practices. The report also provides a detailed analysis of the global critical minerals market, including supply, demand, and trade patterns.

The China's power over rare earths is not as great as it seems provides a comprehensive analysis of the global critical minerals market, including supply, demand, and trade patterns. The report highlights the importance of critical minerals for the global economy and the need for sustainable and responsible mining practices. The report also provides a detailed analysis of the global critical minerals market, including supply, demand, and trade patterns.

The US rare-earth pricing system is poised to challenge China's dominance provides a comprehensive analysis of the global critical minerals market, including supply, demand, and trade patterns. The report highlights the importance of critical minerals for the global economy and the need for sustainable and responsible mining practices. The report also provides a detailed analysis of the global critical minerals market, including supply, demand, and trade patterns.

The A make or break year for non-chinese gallium market 2024 preview provides a comprehensive analysis of the global critical minerals market, including supply, demand, and trade patterns. The report highlights the importance of critical minerals for the global economy and the need for sustainable and responsible mining practices. The report also provides a detailed analysis of the global critical minerals market, including supply, demand, and trade patterns.

The Rare earths and minor metals provides a comprehensive analysis of the global critical minerals market, including supply, demand, and trade patterns. The report highlights the importance of critical minerals for the global economy and the need for sustainable and responsible mining practices. The report also provides a detailed analysis of the global critical minerals market, including supply, demand, and trade patterns.

The Recycling of critical minerals provides a comprehensive analysis of the global critical minerals market, including supply, demand, and trade patterns. The report highlights the importance of critical minerals for the global economy and the need for sustainable and responsible mining practices. The report also provides a detailed analysis of the global critical minerals market, including supply, demand, and trade patterns.

The Recycling kick-long term solution for EU rare earths challenge provides a comprehensive analysis of the global critical minerals market, including supply, demand, and trade patterns. The report highlights the importance of critical minerals for the global economy and the need for sustainable and responsible mining practices. The report also provides a detailed analysis of the global critical minerals market, including supply, demand, and trade patterns.

The Rare earth magnet recycling technology branches out provides a comprehensive analysis of the global critical minerals market, including supply, demand, and trade patterns. The report highlights the importance of critical minerals for the global economy and the need for sustainable and responsible mining practices. The report also provides a detailed analysis of the global critical minerals market, including supply, demand, and trade patterns.

The Supply tightness boosts indium prices to near nine-year highs provides a comprehensive analysis of the global critical minerals market, including supply, demand, and trade patterns. The report highlights the importance of critical minerals for the global economy and the need for sustainable and responsible mining practices. The report also provides a detailed analysis of the global critical minerals market, including supply, demand, and trade patterns.

The China's rare earths ban: Why we should be concerned provides a comprehensive analysis of the global critical minerals market, including supply, demand, and trade patterns. The report highlights the importance of critical minerals for the global economy and the need for sustainable and responsible mining practices. The report also provides a detailed analysis of the global critical minerals market, including supply, demand, and trade patterns.

The Global Critical Minerals Outlook 2024 provides a comprehensive analysis of the global critical minerals market, including supply, demand, and trade patterns. The report highlights the importance of critical minerals for the global economy and the need for sustainable and responsible mining practices. The report also provides a detailed analysis of the global critical minerals market, including supply, demand, and trade patterns.

The US rare-earth pricing system is poised to challenge China's dominance provides a comprehensive analysis of the global critical minerals market, including supply, demand, and trade patterns. The report highlights the importance of critical minerals for the global economy and the need for sustainable and responsible mining practices. The report also provides a detailed analysis of the global critical minerals market, including supply, demand, and trade patterns.

The US rare-earth neodymium magnets, China, and geopolitics provides a comprehensive analysis of the global critical minerals market, including supply, demand, and trade patterns. The report highlights the importance of critical minerals for the global economy and the need for sustainable and responsible mining practices. The report also provides a detailed analysis of the global critical minerals market, including supply, demand, and trade patterns.

The US rare-earth pricing system is poised to challenge China's dominance provides a comprehensive analysis of the global critical minerals market, including supply, demand, and trade patterns. The report highlights the importance of critical minerals for the global economy and the need for sustainable and responsible mining practices. The report also provides a detailed analysis of the global critical minerals market, including supply, demand, and trade patterns.

The Piece of hafnium provides a comprehensive analysis of the global critical minerals market, including supply, demand, and trade patterns. The report highlights the importance of critical minerals for the global economy and the need for sustainable and responsible mining practices. The report also provides a detailed analysis of the global critical minerals market, including supply, demand, and trade patterns.

The Zirconium and hafnium provides a comprehensive analysis of the global critical minerals market, including supply, demand, and trade patterns. The report highlights the importance of critical minerals for the global economy and the need for sustainable and responsible mining practices. The report also provides a detailed analysis of the global critical minerals market, including supply, demand, and trade patterns.

The Rhenium provides a comprehensive analysis of the global critical minerals market, including supply, demand, and trade patterns. The report highlights the importance of critical minerals for the global economy and the need for sustainable and responsible mining practices. The report also provides a detailed analysis of the global critical minerals market, including supply, demand, and trade patterns.

The Gallium provides a comprehensive analysis of the global critical minerals market, including supply, demand, and trade patterns. The report highlights the importance of critical minerals for the global economy and the need for sustainable and responsible mining practices. The report also provides a detailed analysis of the global critical minerals market, including supply, demand, and trade patterns.

The Future of critical minerals 2025 preview provides a comprehensive analysis of the global critical minerals market, including supply, demand, and trade patterns. The report highlights the importance of critical minerals for the global economy and the need for sustainable and responsible mining practices. The report also provides a detailed analysis of the global critical minerals market, including supply, demand, and trade patterns.

The Indium provides a comprehensive analysis of the global critical minerals market, including supply, demand, and trade patterns. The report highlights the importance of critical minerals for the global economy and the need for sustainable and responsible mining practices. The report also provides a detailed analysis of the global critical minerals market, including supply, demand, and trade patterns.

The Supply tightness boosts indium prices to near nine-year highs provides a comprehensive analysis of the global critical minerals market, including supply, demand, and trade patterns. The report highlights the importance of critical minerals for the global economy and the need for sustainable and responsible mining practices. The report also provides a detailed analysis of the global critical minerals market, including supply, demand, and trade patterns.

The US rare-earth pricing system is poised to challenge China's dominance provides a comprehensive analysis of the global critical minerals market, including supply, demand, and trade patterns. The report highlights the importance of critical minerals for the global economy and the need for sustainable and responsible mining practices. The report also provides a detailed analysis of the global critical minerals market, including supply, demand, and trade patterns.

The China's rare earths ban: Why we should be concerned provides a comprehensive analysis of the global critical minerals market, including supply, demand, and trade patterns. The report highlights the importance of critical minerals for the global economy and the need for sustainable and responsible mining practices. The report also provides a detailed analysis of the global critical minerals market, including supply, demand, and trade patterns.

The US rare-earth neodymium magnets, China, and geopolitics provides a comprehensive analysis of the global critical minerals market, including supply, demand, and trade patterns. The report highlights the importance of critical minerals for the global economy and the need for sustainable and responsible mining practices. The report also provides a detailed analysis of the global critical minerals market, including supply, demand, and trade patterns.

The US rare-earth pricing system is poised to challenge China's dominance provides a comprehensive analysis of the global critical minerals market, including supply, demand, and trade patterns. The report highlights the importance of critical minerals for the global economy and the need for sustainable and responsible mining practices. The report also provides a detailed analysis of the global critical minerals market, including supply, demand, and trade patterns.

The China's rare earths ban: Why we should be concerned provides a comprehensive analysis of the global critical minerals market, including supply, demand, and trade patterns. The report highlights the importance of critical minerals for the global economy and the need for sustainable and responsible mining practices. The report also provides a detailed analysis of the global critical minerals market, including supply, demand, and trade patterns.

Why Investors Choose Us

Physically backed, always redeemable

Each token corresponds to a fixed basket of critical metals, insured and audited — not just exposure, but real ownership.

Built for regulatory clarity

Issued under the Article 18(1) MiCA exemption, with full compliance, custody segregation, and transparency standards in place.

No rebalancing risk, no leverage

Our basket is fixed by weight, not by price. You always know what you own.

Secure, duty-free vault storage

Stored in bonded facilities — VAT-exempt, customs-free, and out of reach of issuer or custodian insolvency.

Low entry, no fine print

Minimum entry of just €100. No management fees. Transparent redemption schedule and policy.

Custody you can trust

Reserve assets are held by a CySEC-regulated investment firm, fully segregated and protected by law — even in the event of issuer default.

Audited and transparent

All reserves are independently audited. Supply, storage, and redemption data are published monthly for full investor visibility.

Stress-tested redemption rights

Built to handle high redemption demand. In any scenario, token holders maintain full legal rights over their pro-rata share of the metals.

No synthetic exposure

You’re not buying a CFD or a tracker. Each token is backed by real, allocated metals — no leverage, no paper claims, no counterparty risk.

Custody, Compliance & Redemption — How We Safeguard Your Wealth

Secure Vault, Regulated Custodian

Metals are stored in Frankfurt at Metlock GmbH — ISO 9001 certified, insured by Mannheimer Versicherung AG

Custody held by Noemon Finance Ltd, a CySEC-regulated investment firm (MiFID II license)

Legally segregated, bankruptcy-remote storage — your rights are fully preserved

Full Redemption Flexibility

Redeem for cash at any time, with transparent pricing

Or opt for monthly physical transfer of the metals (≥ €10,000 value) via book-entry to a regulated account

All redemptions permanently burn the token — your ownership becomes physical

MiCA Article 37 compliance: custodian and issuer are legally distinct entities, ensuring ultimate asset security.

“Rare earth metals are making headlines as demand rises for products from smartphones to wind turbines, and as governments seek secure supply.”

“China on Tuesday banned exports to the United States of the critical minerals gallium, germanium ….”

“Critical raw materials are indispensable for the EU economy and necessary for a wide range of technologies in strategic sectors such as renewable energy, digital, aerospace, and defence.”

“The EU faces a critical juncture in securing sustainable supplies of raw materials essential for its clean energy transition.”

How it works — Seamless in 3 Steps

Create and Verify Your Account

Set up your profile in minutes. We're licensed under CySEC — your identity is safe, your rights are protected.

Fund Your Wallet

Deposit EUR or stablecoins. Transparent conversion at the day's NAV — no spreads, no hidden markups.

Buy and Hold Your Tokens

Each token is 1:1 backed by physical metals stored in a duty-free vault in Germany. Track daily NAV, redeem anytime.

Invest like an institution. Redeem like an owner.